Sector 59 in Gurgaon has become one of the hottest spots for property development. Rapid growth, new infrastructure, and modern amenities have made it very attractive for investors and homebuyers. But buying property here isn’t just about picking the first option you see. If you rush or make quick decisions, you could end up losing money or facing legal troubles. Knowing what to avoid is crucial. Many buyers fall into common traps that can be costly later. Doing your homework and understanding the market makes all the difference. The tips below will help you dodge those mistakes and secure a safe investment.

Understanding the Sector 59 Gurgaon Real Estate Market

Market Trends and Future Outlook

Sector 59 has seen a steady rise in property prices over the past few years. Recent statistics show appreciation rates averaging around 8-10% annually. Upcoming projects like the Dwarka Expressway and new metro stations are expected to boost property values further. Experts predict property prices will keep climbing as these developments come into play. If you plan carefully, investing now could bring good returns in the future. Do your research on current market trends and upcoming infrastructure to judge if it’s the right time to buy.

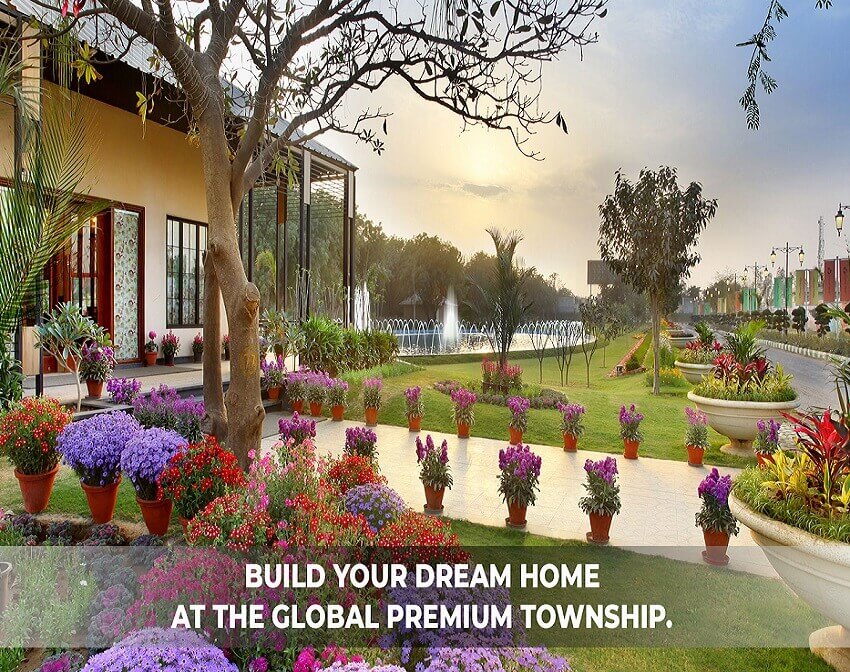

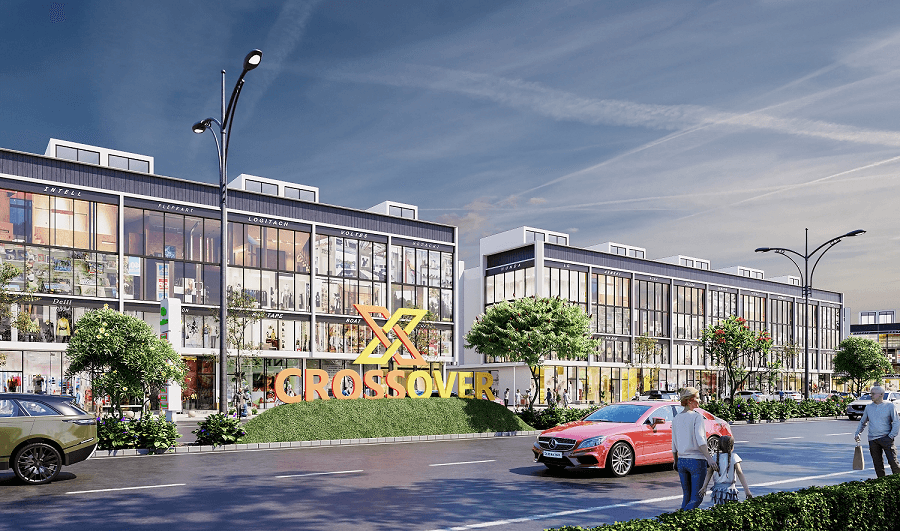

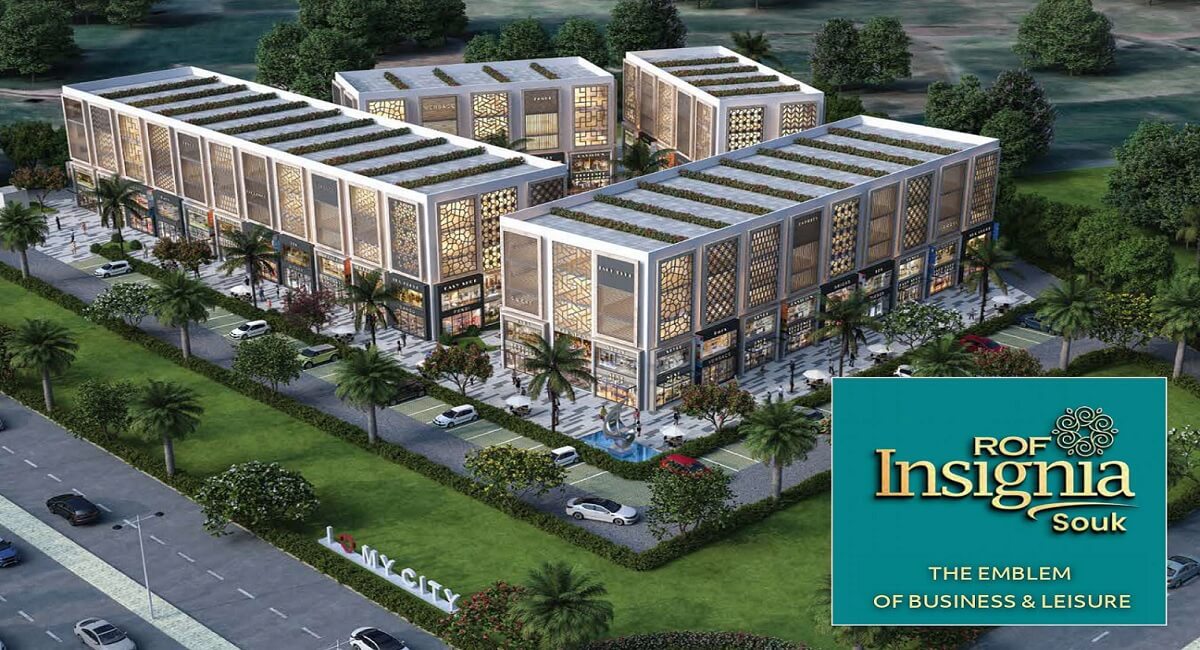

Types of Properties Available

Here, you’ll find a mix of residential apartments, commercial spaces, and luxury villas. Each property type suits different investment goals. Residential flats might be good for long-term rental income, while commercial spaces can offer quick returns. Luxury villas attract wealthy buyers looking for premium lifestyles. Always match your choice with your financial goals. If you want steady income, apartments with good rental demand make sense. For capital appreciation, premium properties or land might be better options.

Common Mistakes in Property Due Diligence

Neglecting Proper Verification of Legal Documents

Many buyers skip verifying legal papers. This can be a costly mistake. Always check ownership titles, approvals from local authorities, and building clearances. Fraudulent documents are common, especially if you don’t know what to look for. Look for clear title deeds and ensure the property is free from legal disputes. You can hire a legal expert or property lawyer to verify these details for peace of mind.

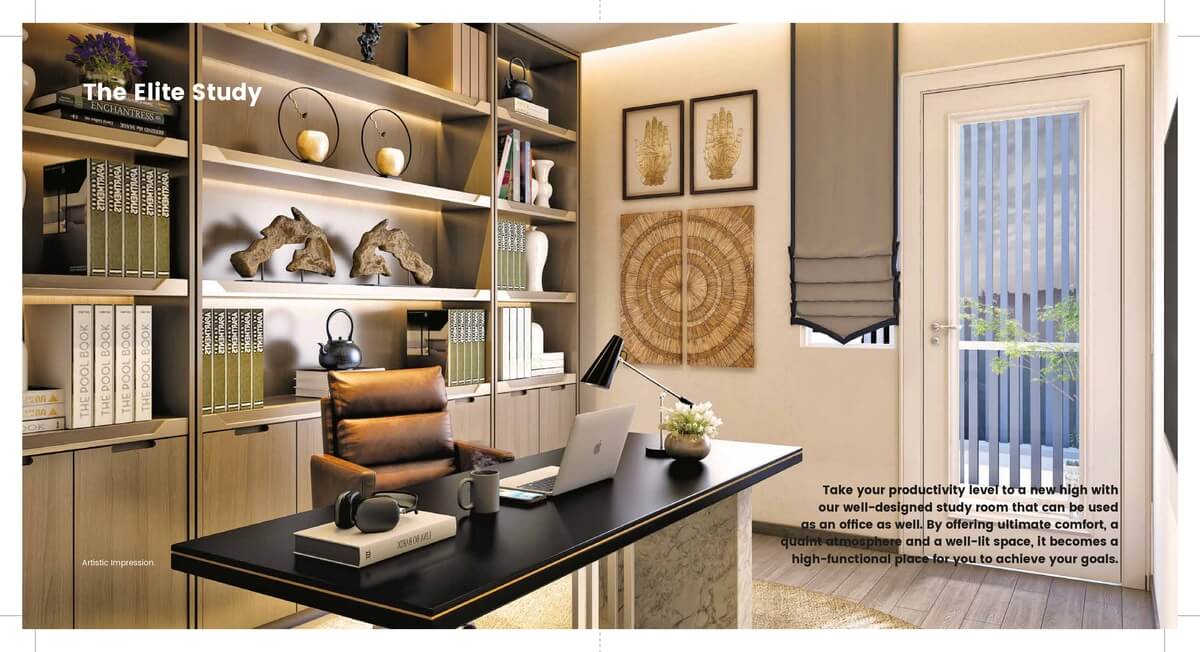

Overlooking Construction Quality and Builder Reputation

Not all builders deliver quality projects. Poor construction can cause issues like cracks, leakage, or even safety hazards. Always research the builder’s past projects. Check reviews, talk to previous buyers, and visit completed developments if possible. A builder with a good track record saves you from future headaches. Confirm if they follow quality standards and hold the necessary licenses.

Ignoring Compliance with Local Regulations

Every property must meet local zoning laws and safety norms. Ignoring these rules could lead to legal issues or fines. Check if the property has all required environmental and fire safety clearances. Don’t buy if the property violates local laws or has pending approvals. Verify compliance by asking for official certificates from authorities.

Financial and Investment Errors to Avoid

Underestimating Total Cost of Ownership

Many buyers focus only on the sale price. But the total cost includes registration fees, stamp duty, taxes, maintenance charges, and property taxes. These hidden costs can add up quickly. Budget for them and avoid surprises. Use online calculators or consult with a financial advisor to understand actual expenses before buying.

Overextending Budget and Financing Risks

Getting a loan might seem easy, but stretching your budget too thin can cause problems later. If the EMI becomes hard to pay, it affects your finances. Choose a mortgage with manageable payments. Keep some buffer for unexpected costs or future expenses. Never buy beyond your means.

Failing to Factor in Market Volatility and Resale Value

Property markets can shift fast. Prices might dip, or demand can drop suddenly. Always look at resale prospects before buying. Ask yourself if you will still want to sell at a profit if needed. Properties close to upcoming metro stations or new highways usually have better resale value.

Due Diligence and Inspection Oversights

Not Conducting Physical Inspections

Don’t skip a visit to the site. Pictures or virtual tours can’t tell you everything. Check the property’s condition, amenities, and surroundings. Walk around to see if everything matches what the brochure shows. Inspect key points like the building’s structure, plumbing, and electrical systems. Make sure everything is in working order.

Relying Solely on Broker or Seller Assurance

Verbal promises can be misleading. Always ask for written agreements and documents. Hire a qualified property inspector or legal advisor to double-check everything. Their expertise can uncover hidden issues and protect your investment.

Ignoring Future Development Plans

Upcoming infrastructure projects can increase property value. Learn about new roads, metro lines, and commercial hubs planned nearby. Access official development authority reports or local government notifications. Knowing future plans helps you avoid buying in areas that might face restrictions or congestion.

Legal and Documentation Pitfalls

Overlooking Encumbrance and Pending Litigation

A property with legal disputes or encumbrances can become worthless. Use professional services to check ownership history and see if the property is free from liens or claims. Search public records and ask for encumbrance certificates. Avoid properties involved in any ongoing legal cases.

Failing to Review Sale Agreements Thoroughly

Sale and lease agreements should be clear and fair. Read every clause carefully. Pay attention to payment terms, possession dates, penalties, and transfer rights. Seek legal advice to ensure your interests are protected and avoid unfavorable conditions.

Post-Purchase Mistakes to Avoid

Not Planning for Future Maintenance and Expenses

Owning property means ongoing costs. From society maintenance to utility bills, these add up. Budget for future expenses from the start. Find out about the building management fee and other recurring costs. Proper planning prevents unexpected financial stress.

Neglecting to Register Property Correctly

Registering your property is a crucial step. It formalizes your ownership and protects you from disputes later on. Delays or incomplete registration can lead to legal problems. Work with a legal professional to follow all steps correctly and secure your rights.

Conclusion

Buying property in Sector 59 Gurgaon offers promising opportunities, but it requires careful planning. Avoid common mistakes like skipping legal checks, ignoring construction quality, or underestimating costs. Do your market research, verify every document, and assess future growth potential. Consulting real estate experts can make the process smoother and safer. Your goal should be a solid investment that stands the test of time. Take your time, ask questions, and always stay informed. Your next property purchase should be a smart step toward your future.