Buying a home is one of the most significant investments you'll ever make, and the process can often be overwhelming. Gurgaon, a thriving metropolitan area, offers a plethora of residential options, making it essential for potential buyers to navigate the market efficiently. This article serves as a comprehensive guide to help you navigate the home buying process in Gurgaon, ensuring you make informed decisions along the way.

1. Understand Your Needs and Budget

Determine Your Requirements

Before you start your home search, it's essential to identify your needs and preferences. Consider the following factors:

- Type of Property: Decide whether you want an apartment, villa, or independent house.

- Size: Determine the number of bedrooms and bathrooms you need based on your family size.

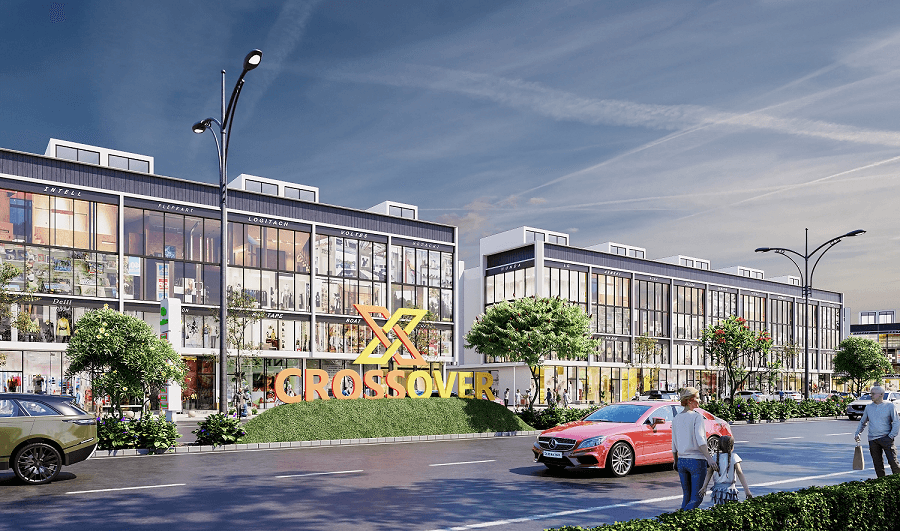

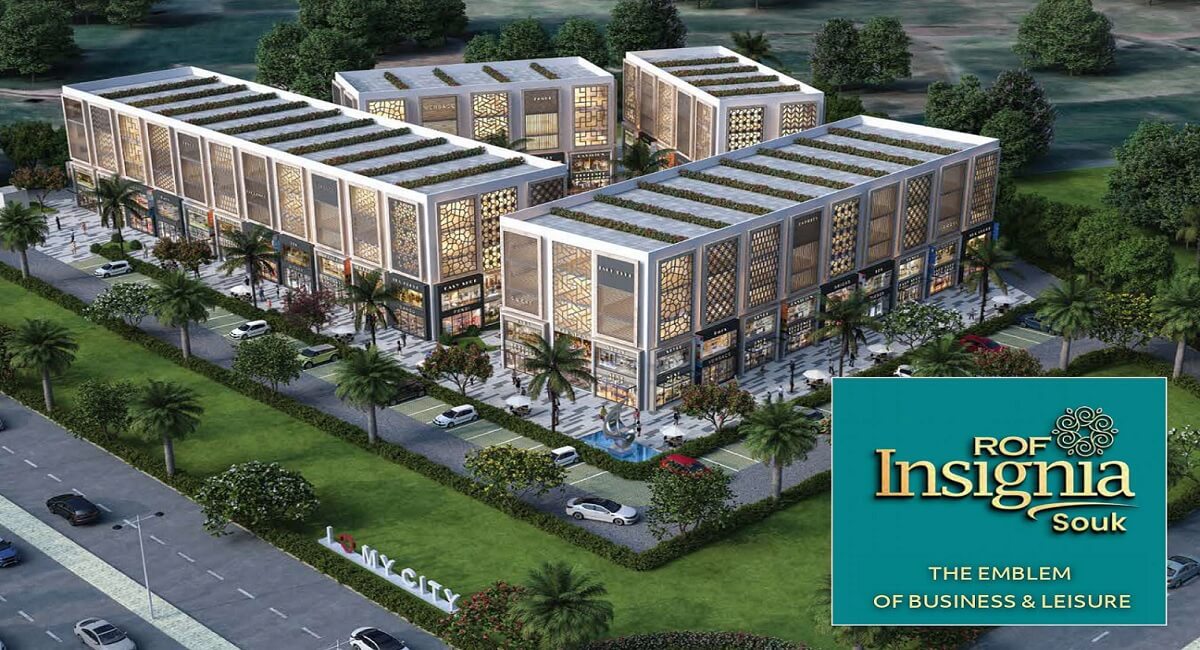

- Amenities: List the amenities that are important to you, such as parking, a gym, or a swimming pool.

Set a Realistic Budget

Setting a budget is crucial to avoid overspending. Consider the following:

- Down Payment: Typically, you will need to pay 10-20% of the property price as a down payment.

- Monthly EMIs: Calculate your potential monthly EMI based on the loan amount and interest rates.

- Additional Costs: Account for property taxes, registration fees, and maintenance costs.

2. Research the Market

Explore Gurgaon’s Real Estate Landscape

Gurgaon is divided into various sectors, each offering different lifestyles and price points. Research the areas that best fit your needs:

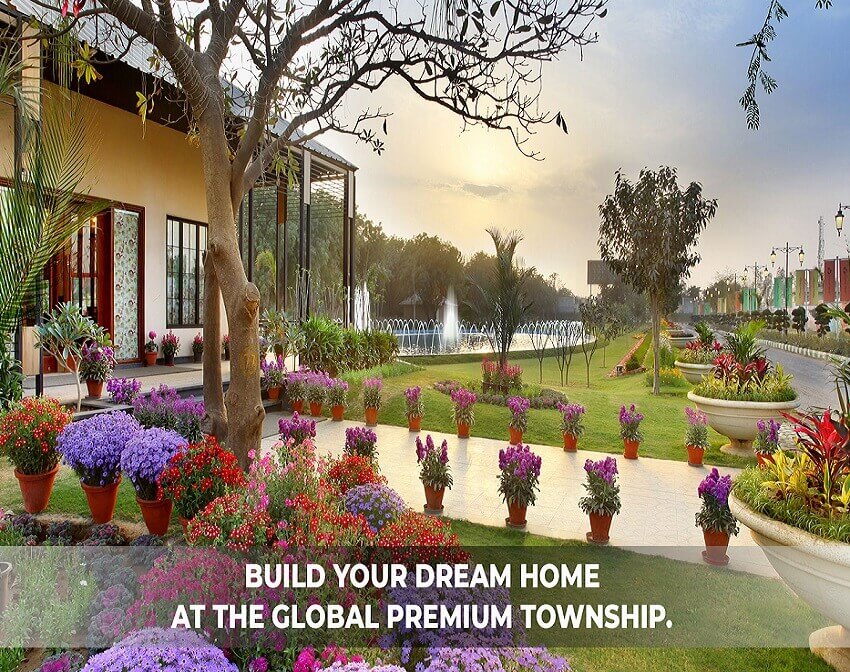

- Sector 105: Known for its Modern Residential Projects and proximity to the Dwarka Expressway.

- Sector 66: A well-developed area with easy access to schools, hospitals, and shopping centers.

- Golf Course Road: Offers luxury apartments and is home to several corporate offices.

Compare Prices

Once you have shortlisted potential areas, compare property prices in each sector. Utilize online real estate platforms to get a sense of market rates and gauge whether a property is overpriced or a good deal.

3. Engage a Real Estate Agent

The Role of a Real Estate Agent

A qualified real estate agent can be invaluable in your home-buying journey. They can:

- Provide local market insights.

- Help you identify properties that meet your criteria.

- Negotiate prices on your behalf.

Choosing the Right Agent

When selecting a real estate agent, consider their experience, client reviews, and local expertise. Ask for references and consult multiple agents to find the one who aligns with your needs.

4. Visit Properties

Schedule Site Visits

Once you have a list of potential properties, it’s time to visit them. Make a schedule and ensure you assess each property carefully. Here are some tips for site visits:

- Take Notes: Jot down your impressions of each property, including pros and cons.

- Ask Questions: Don’t hesitate to ask the agent or seller questions about the property’s history, maintenance, and any associated fees.

- Check Surroundings: Evaluate the neighborhood, amenities, and accessibility to essential services like schools and hospitals.

5. Assess Property Documentation

Verify Legal Documents

Before finalizing a purchase, ensure that all necessary legal documents are in order. Key documents include:

- Title Deed: Confirms the seller's ownership of the property.

- Sale Agreement: Outlines the terms of the sale, including the payment schedule.

- Occupancy Certificate: Confirms that the property is safe for habitation.

Seek Legal Advice

Consider hiring a lawyer specializing in real estate to help you review documents and ensure that everything is in compliance with local laws.

6. Financial Planning

Exploring Home Loan Options

If you require financing, explore home loan options available through banks and financial institutions. Key factors to consider:

- Interest Rates: Compare rates from different lenders to find the best deal.

- Loan Tenure: Decide on a suitable tenure based on your financial situation.

- Processing Fees: Be aware of any additional costs involved in securing the loan.

Pre-Approval Process

Getting pre-approved for a home loan can strengthen your bargaining position. Lenders will assess your financial status and provide a letter indicating how much they are willing to lend you, making it easier to set a budget.

7. Make an Offer

Preparing Your Offer

Once you’ve found a property you wish to buy, it’s time to make an offer. Consider these steps:

- Competitive Pricing: Based on your research and property assessment, determine a fair price.

- Contingencies: Include any contingencies, such as inspection or financing, that must be met for the sale to go through.

- Earnest Money Deposit: Be prepared to make a small deposit to show the seller you are serious.

Negotiation

Negotiation is often part of the home buying process. Be ready to discuss terms with the seller and consider their counteroffers. Your real estate agent can assist you in this process.

8. Complete the Paperwork

Sale Agreement and Payment

Once both parties agree on the terms, a sale agreement will be drafted. Key components of the agreement include:

- Property Details: A detailed description of the property being sold.

- Payment Terms: A clear outline of payment schedules and amounts.

- Possession Date: When the buyer will take possession of the property.

Registering the Property

Property registration is a crucial step in the home buying process. Ensure that:

- The property is registered in your name with the local sub-registrar’s office.

- You pay the applicable stamp duty and registration fees.

9. Take Possession

Final Inspection

Before taking possession, conduct a final inspection of the property to ensure that everything is in order. Check for any damages or issues that need to be addressed before moving in.

Move-In Preparations

Once the final inspection is complete, it’s time to prepare for your move. Here are some steps to consider:

- Utilities: Set up essential services like electricity, water, and internet.

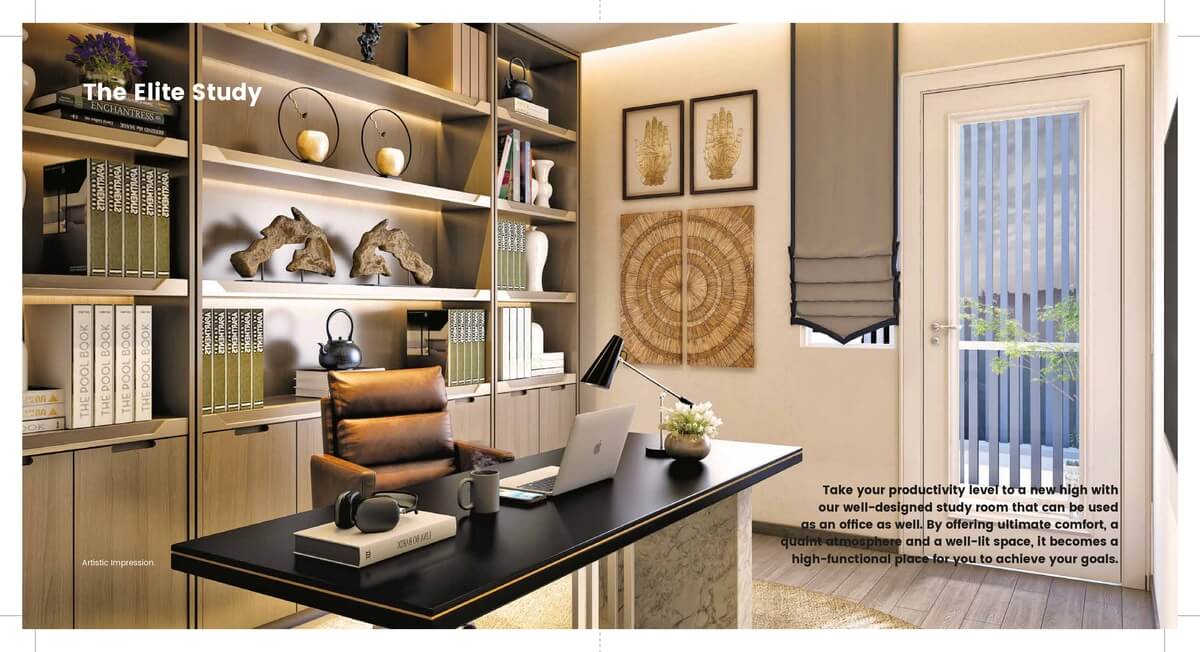

- Interior Setup: Plan your interior design and furniture arrangement to create a comfortable living space.

10. Post-Purchase Considerations

Home Maintenance

Once you have moved in, regular maintenance becomes essential to protect your investment. Create a home maintenance checklist that includes:

- Regular Cleaning: Keep your home clean and organized.

- Repairs: Address minor repairs promptly to prevent larger issues.

- Landscaping: Maintain outdoor spaces to enhance curb appeal.

Community Engagement

Living in a community offers opportunities for social interaction and networking. Engage with your neighbors and participate in community events to build relationships and feel more at home.

Conclusion

Navigating the home buying process in Gurgaon can be straightforward if you take the right steps and remain informed. From understanding your needs and setting a budget to engaging a real estate agent and verifying documentation, each step is crucial in ensuring a successful purchase.

Don’t miss out on this opportunity! Act now and schedule your site visit today. Provide your details at +91 96543 66000, email us at info@reiasindia.com, or visit our website at www.reiasindia.com for more information. Start your journey to homeownership in Gurgaon today!