Purchasing a home is a significant milestone, and navigating the buying process can be both exciting and challenging. Tulip Crimson, located in Sector 70, Gurgaon, offers a premium residential experience with modern amenities and a prime location. This comprehensive guide will walk you through each step of the home-buying process, from initial research to finalizing your purchase, ensuring a smooth and informed journey.

1. Research and Preparation

Understand Your Needs and Preferences:

- Budget Assessment: Determine your budget by evaluating your finances, including savings, income, and existing liabilities. Consider additional costs such as registration fees, maintenance charges, and property taxes.

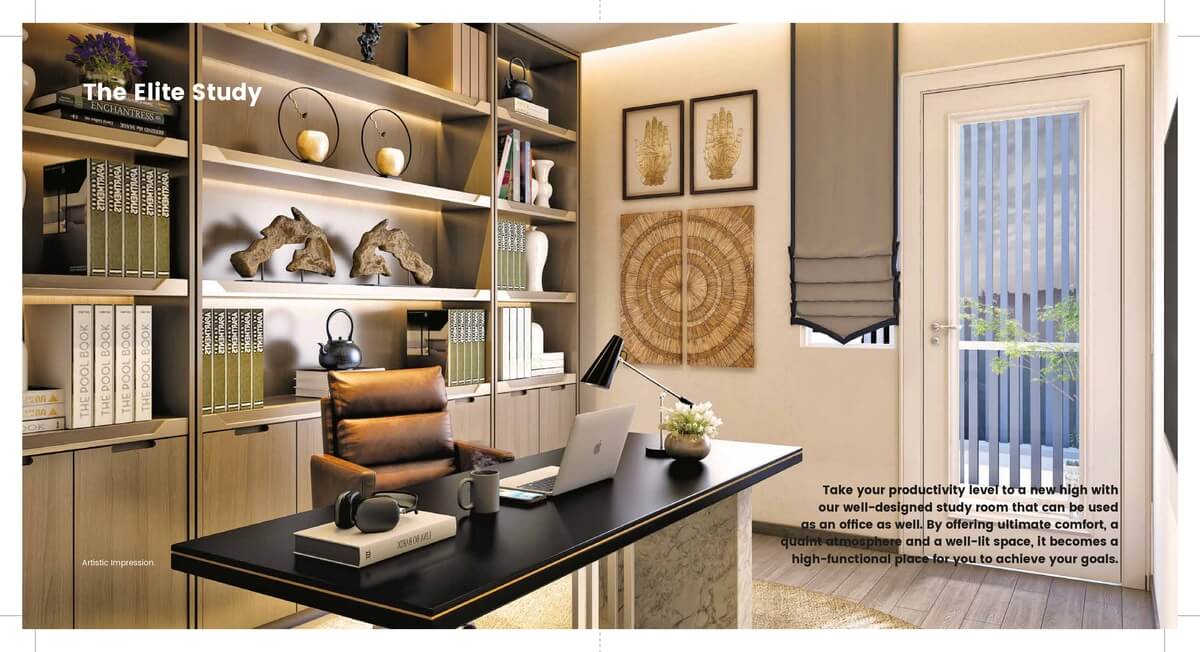

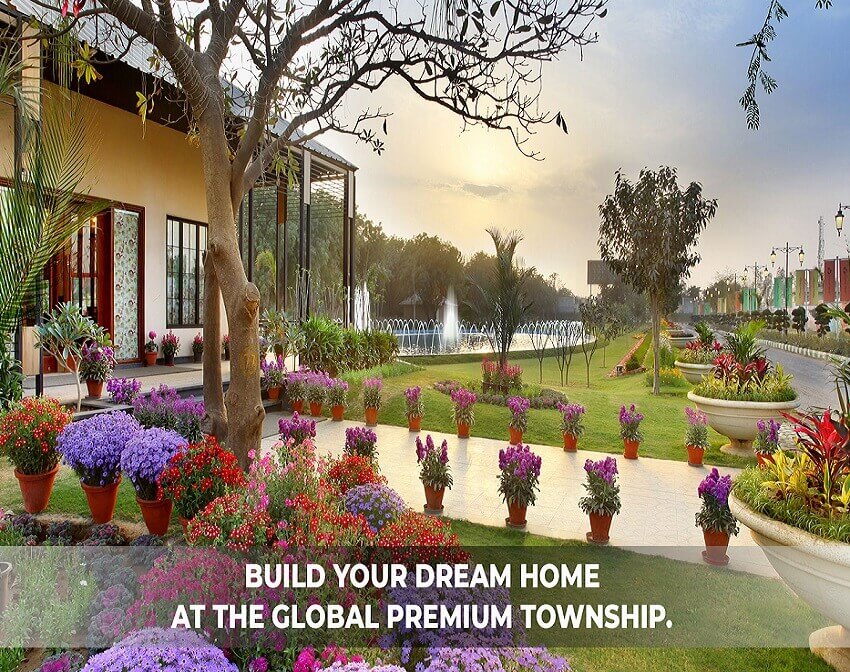

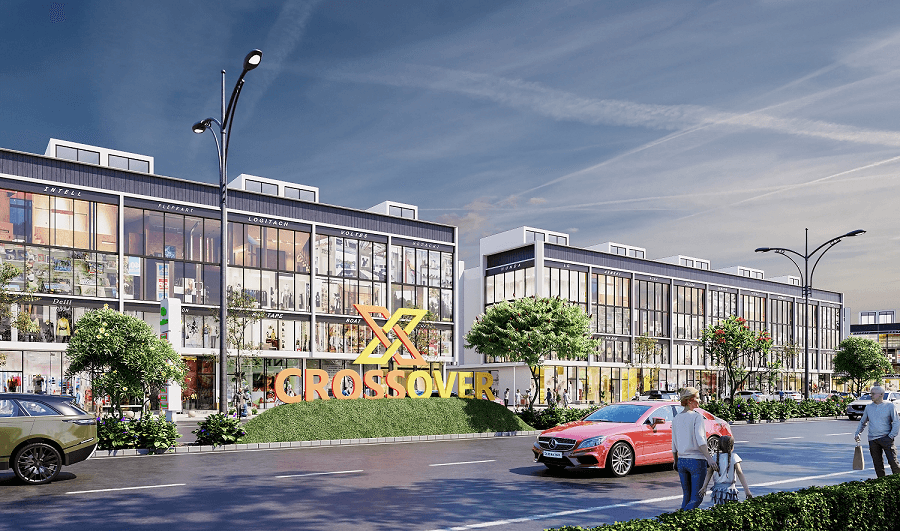

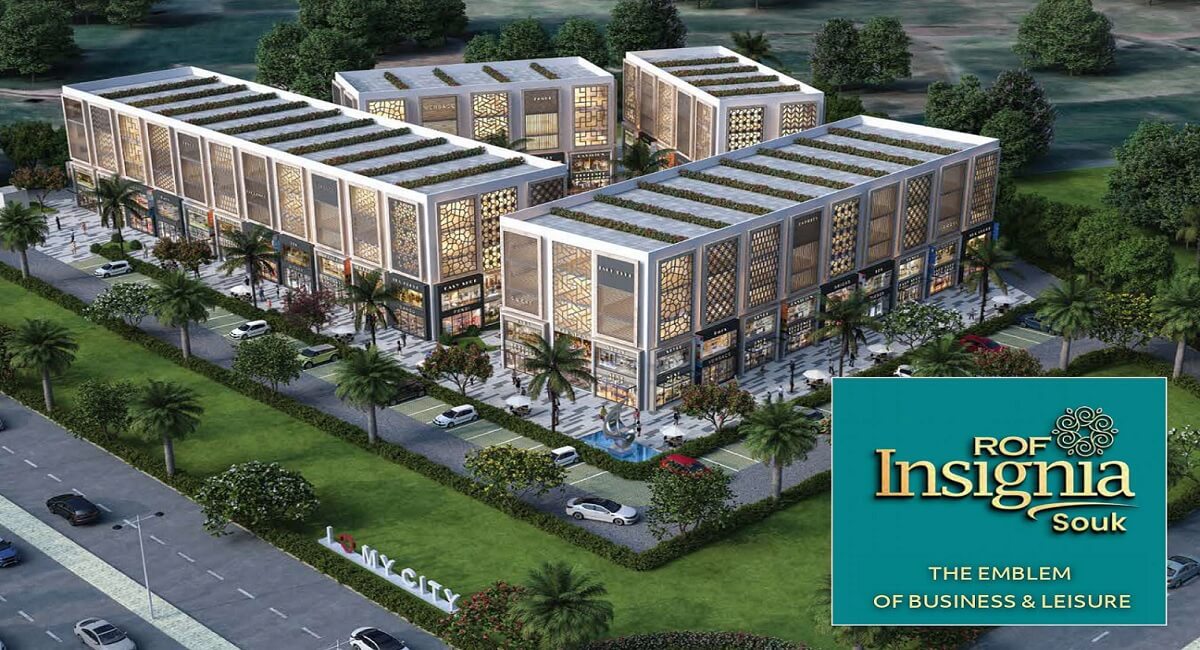

- Desired Features: List your must-have features, such as the number of bedrooms, type of amenities, and proximity to work or schools. Tulip Crimson offers a range of amenities, including a gym, swimming pool, and community spaces, so prioritize what is most important to you.

Market Research:

- Property Comparison: Research similar properties in Sector 70 and surrounding areas to understand market rates and evaluate the value proposition of Tulip Crimson.

- Developer Reputation: Investigate the reputation of the developer, Tulip Infratech, by reviewing their past projects, customer feedback, and industry standing.

2. Initial Inquiry and Site Visit

Contact the Developer or Real Estate Agent:

- Reach Out: Contact the developer directly or work with a real estate agent who can provide detailed information about Tulip Crimson. Use the contact details provided: +91 99999 64462 or email info@reiasindia.com.

- Schedule a Visit: Arrange a site visit to Tulip Crimson to experience the property firsthand. You can schedule this visit through the developer’s website at Tulip Crimson Sector 70 Gurgaon or visit their office at R-2131, M3M Cosmopolitan, Sector 66, Gurgaon.

Prepare for the Site Visit:

- Checklist: Make a checklist of questions and concerns to discuss during your visit. This might include queries about the property’s features, construction quality, and community rules.

- Take Notes: Document your observations during the site visit, including the condition of the property, layout of the apartment, and the quality of amenities.

3. Evaluate Financing Options

Explore Financing Options:

- Home Loans: Research different home loan options from banks and financial institutions. Compare interest rates, loan terms, and eligibility criteria to find the best option for your needs.

- Pre-Approval: Obtain a pre-approval letter from your chosen lender. This will give you a clear idea of how much you can borrow and strengthen your position when making an offer.

Calculate Additional Costs:

- Down Payment: Typically, a down payment ranges from 10% to 20% of the property’s purchase price. Ensure you have sufficient funds for this initial payment.

- Additional Fees: Budget for additional expenses such as registration fees, stamp duty, legal fees, and maintenance charges.

4. Make an Offer and Negotiate

Submit an Offer:

- Formal Offer: Once you decide on the apartment and are satisfied with your visit, submit a formal offer to purchase. This will include your proposed purchase price, down payment amount, and preferred terms and conditions.

- Earnest Money Deposit: Pay an earnest money deposit to demonstrate your seriousness about the purchase. This amount is typically a percentage of the purchase price and is adjusted against the final payment.

Negotiate Terms:

- Price Negotiation: Negotiate with the developer or seller on the purchase price and terms. This may involve discussions on discounts, additional amenities, or flexible payment plans.

- Review Terms: Ensure that all negotiated terms are included in the formal agreement to avoid misunderstandings later.

5. Legal and Documentation

Review Legal Documents:

- Sale Agreement: Thoroughly review the sale agreement, which outlines the terms and conditions of the purchase. Seek legal advice if necessary to ensure that the agreement protects your interests.

- Title Deed and Property Papers: Verify that the title deed is clear and that the property has all necessary approvals and certifications. This includes checking for land use approvals, occupancy certificates, and building permits.

Complete Required Documentation:

- Identity and Address Proof: Provide necessary documents such as proof of identity, address, and income to complete the purchasing process.

- Loan Documentation: If financing through a home loan, submit all required documents to your lender for approval and processing.

6. Finalize the Purchase

Sign the Sale Deed:

- Execution: Once all terms are agreed upon and documentation is complete, sign the sale deed. This legal document formalizes the transfer of ownership from the seller to you.

- Registration: Register the sale deed with the local sub-registrar office to make the transaction legally binding. This process involves paying stamp duty and registration fees.

Complete Payment:

- Final Payment: Make the final payment as per the terms of the agreement. This includes the remaining balance of the purchase price after adjusting for the earnest money deposit and any other payments made.

Handover of Possession:

- Possession Date: Coordinate with the developer to schedule the handover of possession. Ensure that all agreed-upon amenities and features are in place before taking possession.

- Inspection: Conduct a final inspection of the property to ensure that it meets your expectations and is in the condition specified in the agreement.

7. Move-In and Post-Purchase Considerations

Move-In Preparation:

- Utilities and Services: Arrange for the activation of utilities such as electricity, water, and internet services before moving in.

- Interior Setup: Plan your interior setup and arrange for any necessary renovations or furnishings.

Post-Purchase Support:

- Maintenance and Repairs: Familiarize yourself with the property’s maintenance procedures and contact details for any repairs or issues that may arise.

- Resident Association: Join the resident association to stay informed about community events, regulations, and updates.

8. Community and Lifestyle Integration

Get Involved in the Community:

- Participate in Events: Engage in community events and activities organized by the resident association to integrate into the neighborhood and build relationships with fellow residents.

- Explore Amenities: Take full advantage of the amenities offered by Tulip Crimson, including the clubhouse, gym, and sports facilities, to enhance your living experience.

Stay Informed:

- Updates and Communication: Stay updated with any changes or announcements related to the property and community through official channels and resident communication platforms.

Conclusion

Navigating the buying process for your home in Tulip Crimson, Sector 70, Gurgaon, involves several key steps, from initial research to finalizing the purchase and integrating into the community. By following this comprehensive guide, you can ensure a smooth and informed journey through the home-buying process. Tulip Crimson offers a blend of luxury, convenience, and modern amenities, making it a compelling choice for prospective homeowners.

Don’t miss out on this opportunity to experience premium living at Tulip Crimson. Act now and schedule your site visit to explore this exceptional property. For more information, provide your details at +91 99999 64462 or email us at info@reiasindia.com. Visit our website at Tulip Crimson Sector 70 Gurgaon or visit our office at R-2131, M3M Cosmopolitan, Sector 66, Gurgaon. We look forward to assisting you in finding your ideal home at Tulip Crimson!