Investing in Property in Gurgaon has become a popular choice for many. Its location next to Delhi, rapid urban growth, and modern infrastructure make it a hot spot in real estate. But, before jumping into this market, it’s important to do your homework. A smart investment depends on good research and planning. This guide aims to give you clear, practical tips. It helps you understand what to look for before Buying Property in Gurgaon, so your money works for you.

Understanding the Gurgaon Real Estate Market

Market Trends and Growth Potential

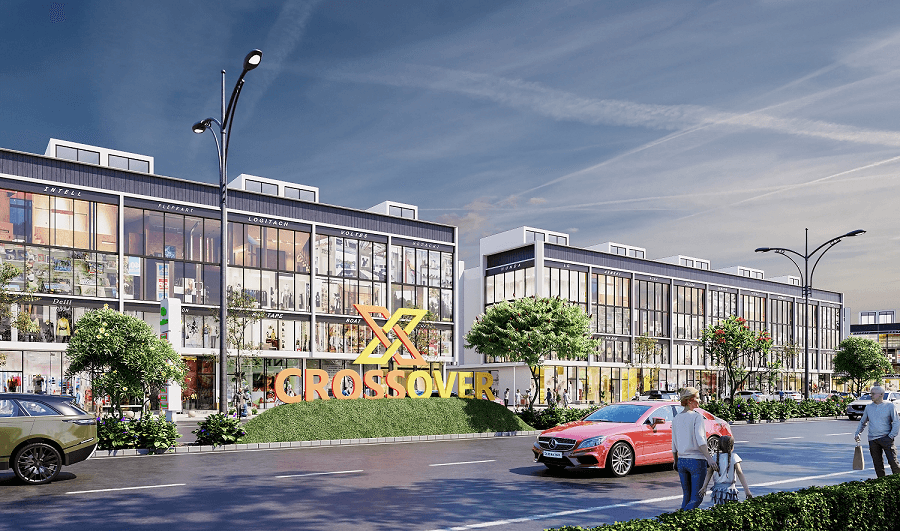

Gurgaon’s property market is growing fast. Over the past few years, prices have increased significantly. The rise in demand mostly comes from big companies setting up offices. As more companies expand, more people want homes here. New roads, metro lines, and shopping malls also add value. Future projects, like new residential towers and commercial hubs, will lift property prices even more. Knowing where the market is heading helps you pick the right time and property type to invest.

Property Types Available in Gurgaon

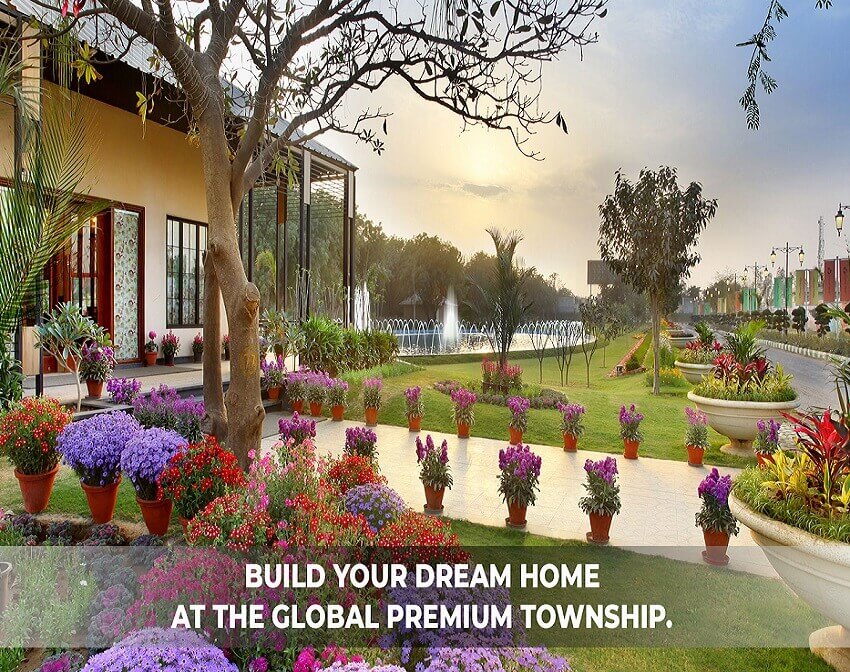

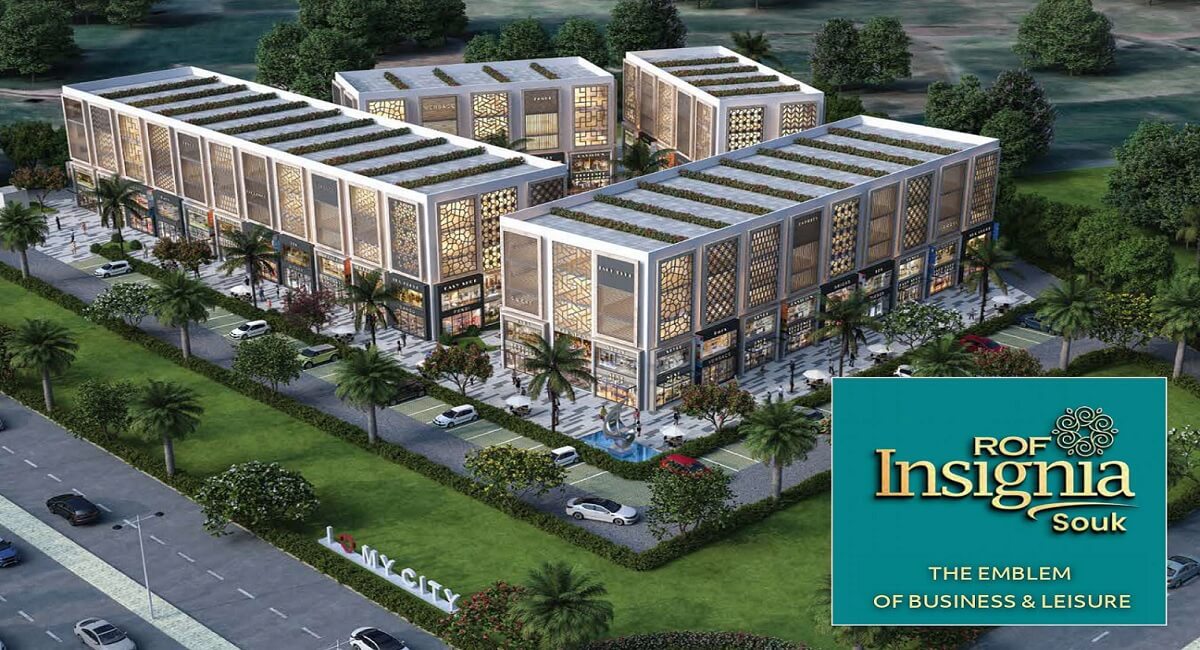

You can find different kinds of properties here. Residential options include apartments in tall towers, private villas, and plotted lands for building your own home. For business purposes, commercial spaces like offices, retail stores, and warehouses are common. An emerging trend is large townships that combine homes, shops, and offices in one area. Whether you want a cozy apartment or a sprawling estate, Gurgaon offers many choices.

Regulatory Environment and Legal Framework

The real estate sector in Gurgaon is protected by rules like the Real Estate Regulatory Authority (RERA). RERA makes sure developers follow laws and complete projects on time. It also gives buyers rights if something goes wrong. But, legal pitfalls are still common. It’s very important to check if the developer has all approvals and clear titles before you buy. Protecting your investment depends on making legal checks and avoiding fraud or false claims.

Key Factors to Consider Before Investing

Location and Connectivity

Where your property is located makes a big difference. Areas like Golf Course Road, Sector 72, or Dwarka Expressway offer easy access to business hubs, schools, and hospitals. Good connectivity, especially proximity to metro stations, increases property value. Think about how close your property is to major roads and future development plans. A prime location is a key to high appreciation and good rental income.

Price Trends and Investment Budget

Study past price trends to understand what to expect. How much have similar properties in the area increased over time? Set a realistic budget that includes everything — registration fees, stamp duty, taxes, and brokerage costs. Don’t forget these extra costs when planning your budget. Staying within your limits helps prevent financial stress later on.

Developer Reputation and Project Credibility

Choose a builder with a good name. Big firms like DLF, Emaar, and Bestech have a strong track record. Check if their past projects were completed on time and meet quality standards. Always verify if the project has proper legal clearances. Reading reviews and talking to previous buyers can give you confidence in your choice. A trusted developer is like a safe bet for your investment.

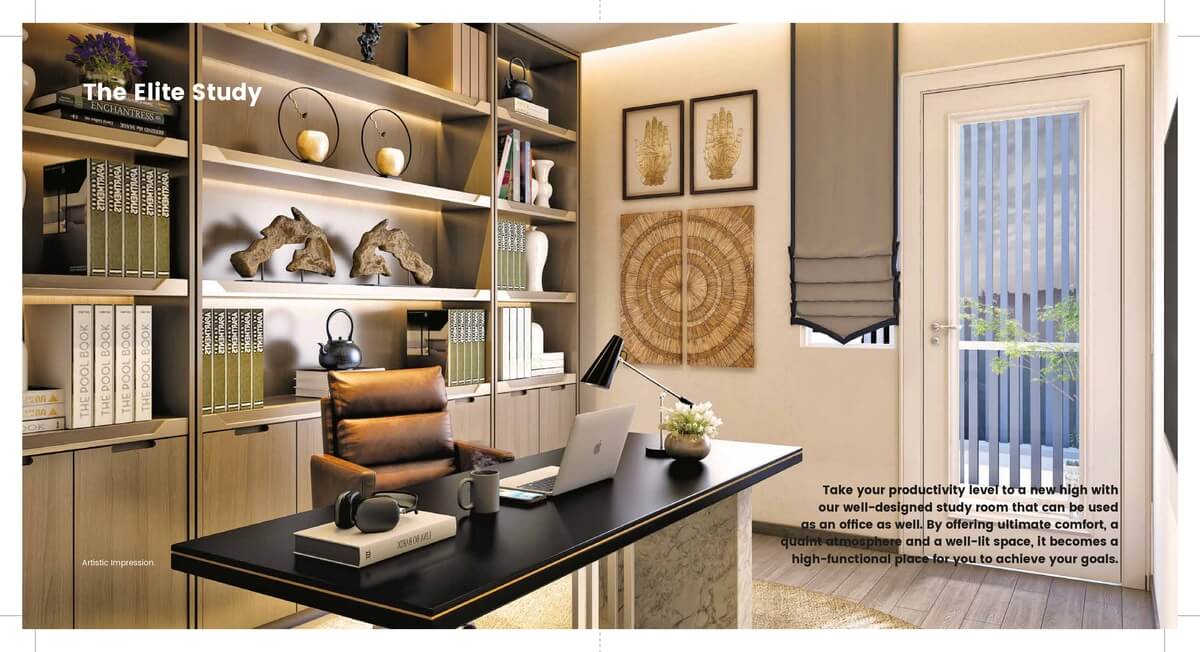

Infrastructure and Amenities

Modern amenities attract tenants and buyers. Look for properties with security, parks, gyms, and shopping centers nearby. Upcoming infrastructure projects like new metro lines or roads increase property value. Well-planned amenities can boost your rental yields. They also make resale easier when you decide to sell later.

Market Entry Timing

Timing your purchase can be crucial. Buying during a market dip or pre-launch offers better prices. Early investors often see higher returns when the area develops. Be cautious if you rush into a deal or wait too long, missing out on growth opportunities. Keep an eye on the market cycle and make decisions based on sound timing.

Financial & Legal Due Diligence

Funding Options and Mortgage Considerations

Most buyers need a loan to finance property purchases. Compare interest rates and loan terms from different banks or NBFCs. A good credit score and income proof can help you get better interest rates. Negotiating loan terms, like lower interest or longer tenure, can make payments easier. Always choose a plan that fits your financial situation.

Title and Ownership Verification

Clear legal ownership is a must. Make sure the property’s title deed is free of dues and disputes. It’s best to hire a legal expert to check the documents. Red flags include multiple owners, pending dues, or incomplete paperwork. Avoid properties with unresolved legal issues to prevent future headaches.

Rental and Resale Potential

Estimate how much rent you can earn based on current market rates. Properties near schools, metro stations, or commercial centers rent well. Resale value depends on location, amenities, and future development. To maximize returns, choose properties that are likely to stay in demand over time.

Practical Tips for a Smart Property Investment in Gurgaon

- Visit multiple sites and do thorough market research.

- Work with trusted real estate agents and legal advisors.

- Check all property documents carefully before signing any deal.

- Focus on long-term growth rather than quick gains.

- Stay updated on upcoming projects, infrastructure plans, and market trends.

Conclusion

Investing in Gurgaon Property offers many opportunities, but it comes with risks. The keys to success include research, choosing the right location, and verifying legal documents. Know your budget and choose reliable developers. Think of your investment as planting a tree — it needs care and patience. With smart planning and expert guidance, your Gurgaon property can grow into a profitable asset. Approach this market with confidence and a clear game plan. Your future self will thank you.